Outlook 2022: change of BOX 3 in the income tax

Regulation 2020

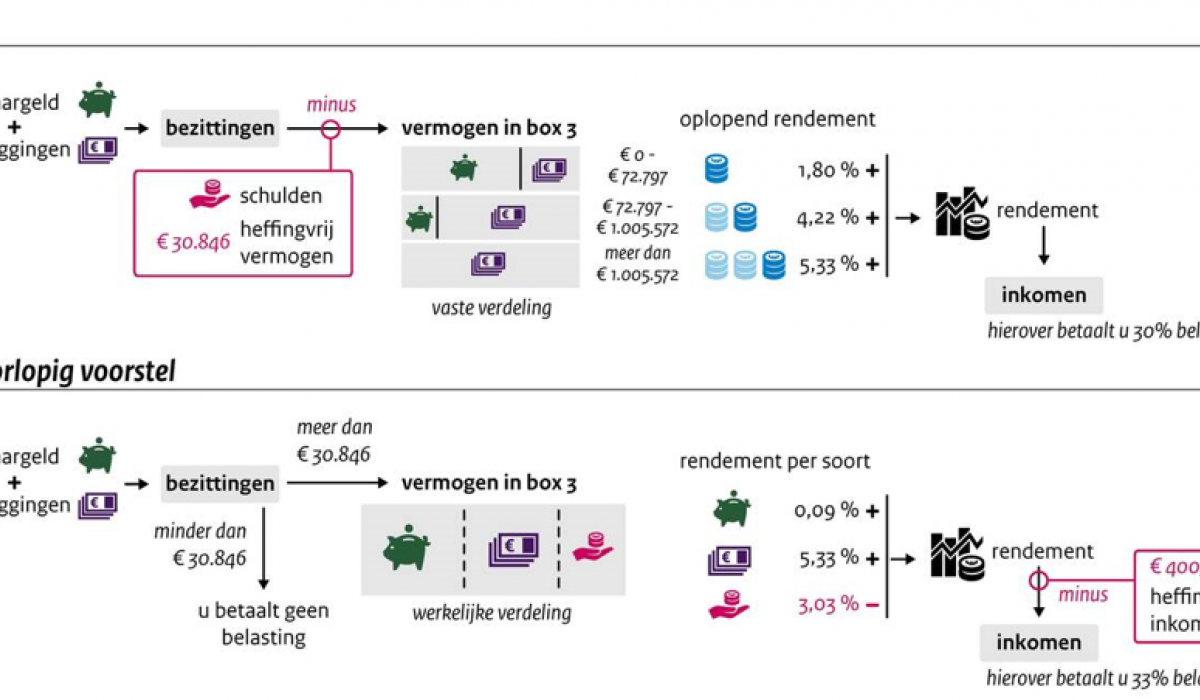

The tax is 30% over the fictitious interest over your capital. the fictitious rate on your capital is higher when your capital is higher. The rate is set between 1.8% and 5.33%. Where the capital is exempt up to €30.846. Debts are deducted from your capital, although there is a threshold of €3.100.

Capital 2022 (proposal)

The tax is 33% over the fictitious rate of your wealth. The fictitious rate is dependent of the nature of your investment, 0,09% for saving and the rest (investment, home) is taxed with 5,33%. The interest on your debts is 3,03% for which a untaxed income of €400 will apply.

Great difference between saving and not saving

Saving will be taxed at 0,09% with €400 of untaxed income from saving and investments will have a free saving capital of €444.444

Other capital (a second home, investments such as shares and bonds) will be taxed at 5,33%. Bonds do not generate a 5,33% interest rate, but will still be taxed at 5,33%.

But pay attention; the fictitious rate can go up and then a untaxed capital is quickly reached for those who save.

Borrow from the BV (LLC)

Borrowing from the BV will be taxed more heavily. Loans above €500.000 will be considered dividend and taxed as such in the income tax. Loans below €500.000 will be taxed in box 3 at 3,03%.

What to do?

Save more but no return

It can be advisable to take a close look at your investment portfolio and ask yourself the question if you make enough income (profit from capital and return). If the income is too low you should consider if a switch to saving is not better for tax reasons.

Set up Savings BV

When you have a lot of investments and you do not want to save you can also consider starting a Savings BV with your box 3 income. In that case you buy shares in your BV for a high price and with that the capital shifts from box 3 to box 2. With interests between 0,09% and 5,33% this can be a solution if the capital is high enough. The total tax of a BV is 40% (VPB +AB taxation) over the actual interest and taxes in box 3 is 33% of the fictitious rate.

Pay attention: Currently this law has not gone into effect. The expectation is that law will be presented to the parliament. At that time we will approach our clients individually for a consultation.